五月回調, 苦啊!!

這個五月回調的原因有,

- 通膨的預期, 包括5/13的CPI指數來到3.6, 創有史以來單月最高

- 失業率或者就業率不高, 有說補助領太多, 大家不願意上班, 也有說還沒有全面開放, 要等待

- 考慮到1+2, 是否產生滯漲?或者通漲? 都會影響到Fed是否會提早縮表

總體來說, 我看原來買的股票, 比較當初買他的原因, 並沒有變差, 而且結果(財報)更好, 所以我相信是回調, 要有信念, 繼續拿著!!! 另外找到投顧的報告, 節錄如下,

簡單的說, 不要喪氣, 未來(三個月)就會有光明!!

The past 15 months have been a terrific time to be a stock market investor. The past 15 days have been far more turbulent.

During times like these, we encourage you to remember the core investing principles behind the long-term investing success:

- Be a long-term investor: Plan to hold stocks for at least 5 years.

- Be a diversified investor: Own at least 25 of our recommendations.

- Be a patient investor: Understand that markets fall on average 10% once per year.

- Be a committed investor: Have a plan and aim to follow it.

- Be an opportunistic investor: If possible, use market volatility to build out positions.

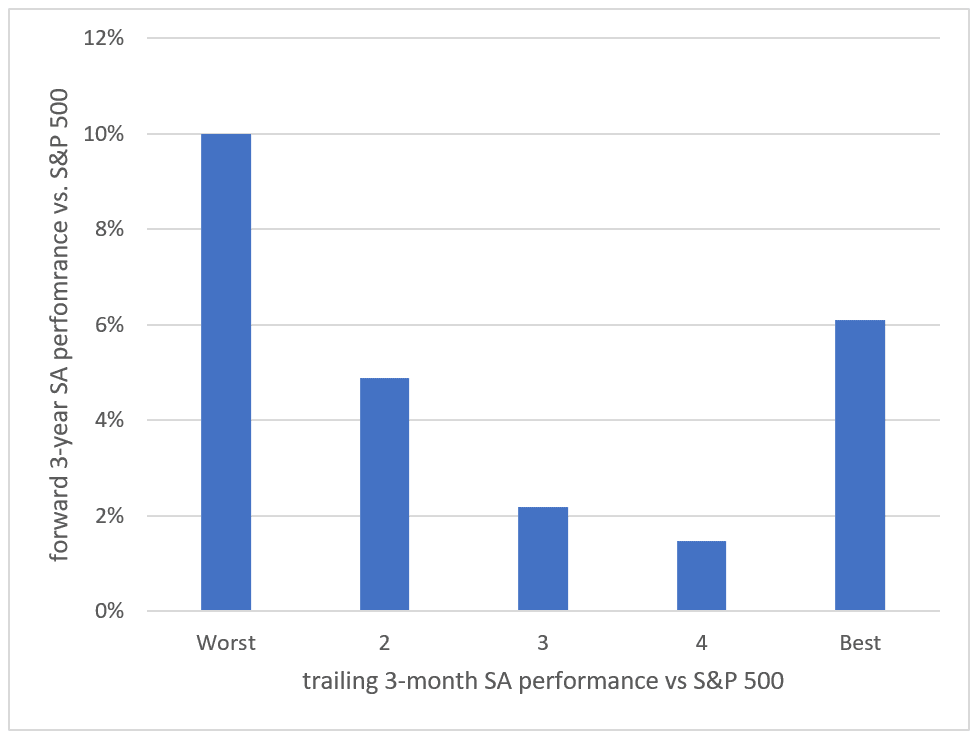

In fact, history is a terrific guide. Historically, the best three-year performance of Stock Advisor against the S&P 500 index has come after their worst short-term performance.

In other words — if there is one time to remain a long-term buyer and holder of Foolish businesses, we’re confident it’s precisely times like these when our stocks are having some of their worst days.

We recommend that you hold those stocks. Our best long-term returns typically emerge out of periods like the one we’re currently going through. If you’re adding new money to your portfolio and have spare cash to invest, we think now is an excellent time to continue diversifying your portfolio across companies we believe in for the next five years.